- Details

- Written by Gordon Prentice

Jennifer McLachlan, the Liberal wannabe MP for Newmarket-Aurora in the forthcoming Federal Election, turns out to be a bit of a disappointment. At least to me.

She is the type of politician who sticks with pleasantries, unable or unwilling to engage in discussion in case she says the wrong thing.

Earlier today, I wander down to the Seniors’ Centre on Davis Drive where I learn that my old friend Dan Deeson is giving one of his periodic talks on electoral reform. He has been doing this for many years, making sense of proportional voting systems and pointing to the failure of First-Past-the-Post.

It’s a public meeting open to all.

I arrive early. Jennifer McLachlan comes towards me and introduces herself. I smile and say hello. I say I know who she is, pointing to the giant name tag with the Liberal logo hanging around her neck. In fact, it’s the first time we’ve met.

Keeping her thoughts to herself

Then it’s over to Dan who walks us through the various alternatives to First-Past-the-Post. From time-to-time people ask questions or make comments but our Liberal candidate stays mum, keeping her thoughts to herself.

I have some issues with the “Fair Votes Canada” approach. I strongly believe any change to the voting system must be validated through a referendum. (I also believe a change will never happen in Canada unless the leaders of the major parties are all signed up for it.)

In recent elections the drop in turnout has been a big concern. Dan gets questions about compulsory voting. What do they do in Australia?

I ask about PR in Israel where the entire country is, in effect, treated as one riding. There, the religious parties have disproportionate influence and the tail wags the dog.

Clearly, all PR systems aren’t equal.

Dan tells me there is no threshold for representation in the Knesset. Most PR countries have a threshold (say 5% of the total national vote) for representation in the national parliament.

Now Dan puts up an interesting slide showing the countries that moved from FPTP to a proportional system – the last being New Zealand in 1993. I am interested in how these countries managed the change.

Sponge

As Dan wraps things up I turn towards Jennifer and ask for her views. Is she happy with FPTP or would she like to see a change?

She says she is just listening. She says she is a sponge soaking up what people have to say.

Oh dear!

Exasperated, I say:

“For goodness sake. You are running for the Federal Parliament. You must have a view!”

Listen and learn

But no. Her job, apparently, is to listen and learn; not to offer a view, even if it is provisional.

I tell her she couldn’t get away with that answer on an election debate stage in front of voters.

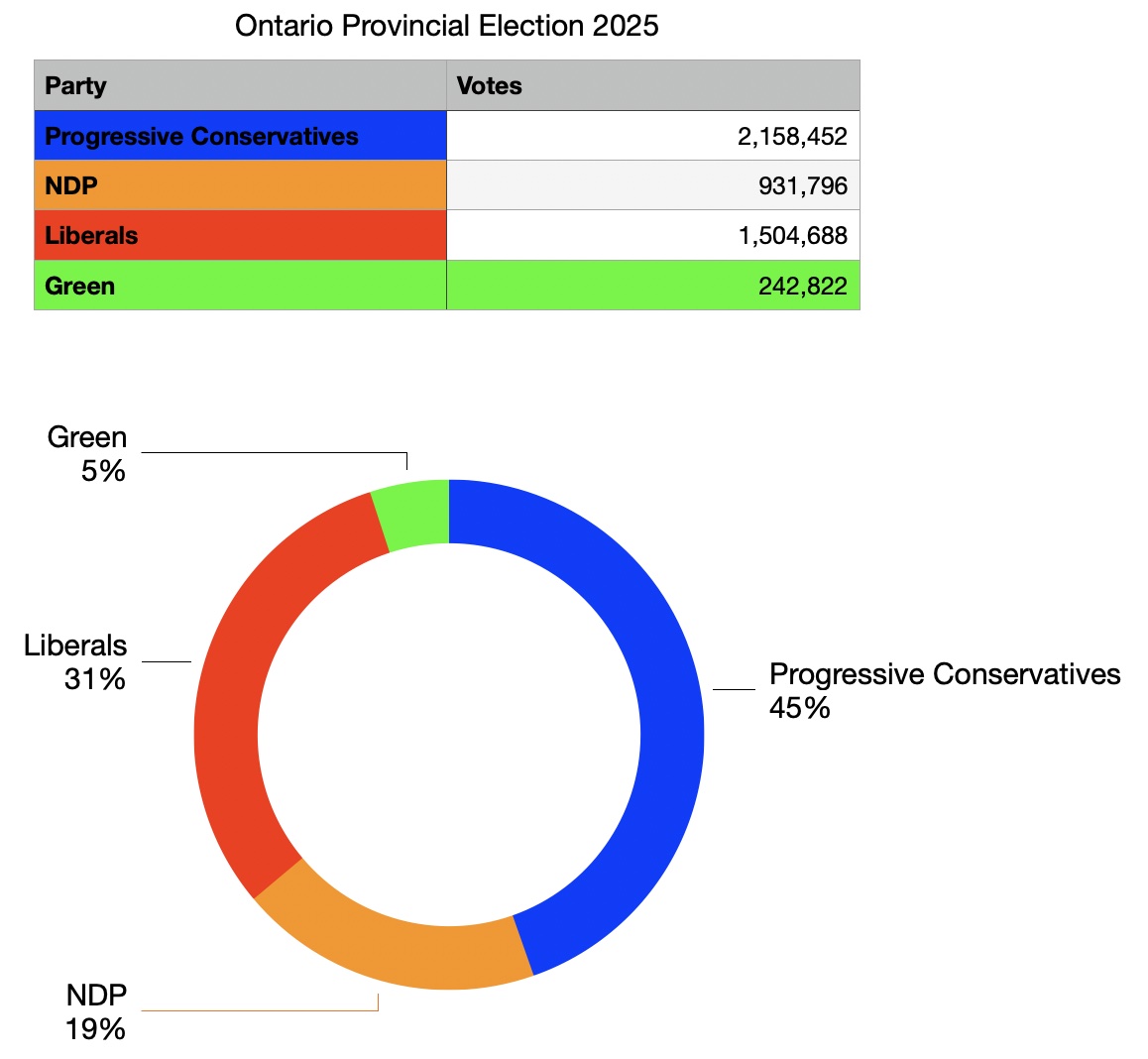

We’ve just had a Provincial election where the Liberals got 31% of the vote and 11% of the seats in the legislature.

No view?

Apparently not.

Public opinion

I’ve always believed politicians have a duty to shape and lead public opinion. It’s in the job description – or should be.

What if Jennifer McLachlan were asked about the conflict in Gaza? Or about the melting of the permafrost in the Arctic? Or banning handguns? Or the thousand other questions that candidates for the Federal Parliament should be able to field.

On the back of the Provincial election results she could have told me the result was clearly unfair to the Liberals but that’s the system and she wasn’t going to campaign to change it. That would have satisfied me.

Disengagement

But to say nothing and to disengage completely from the argument – having sat through a 50-minute presentation – was jaw-dropping.

I voted for the Liberal Chris Ballard in last month’s Provincial election.

If I had asked him for his views on electoral reform and he told me he was a sponge, soaking up views on the issue before he ventured an opinion, he wouldn’t have got my vote.

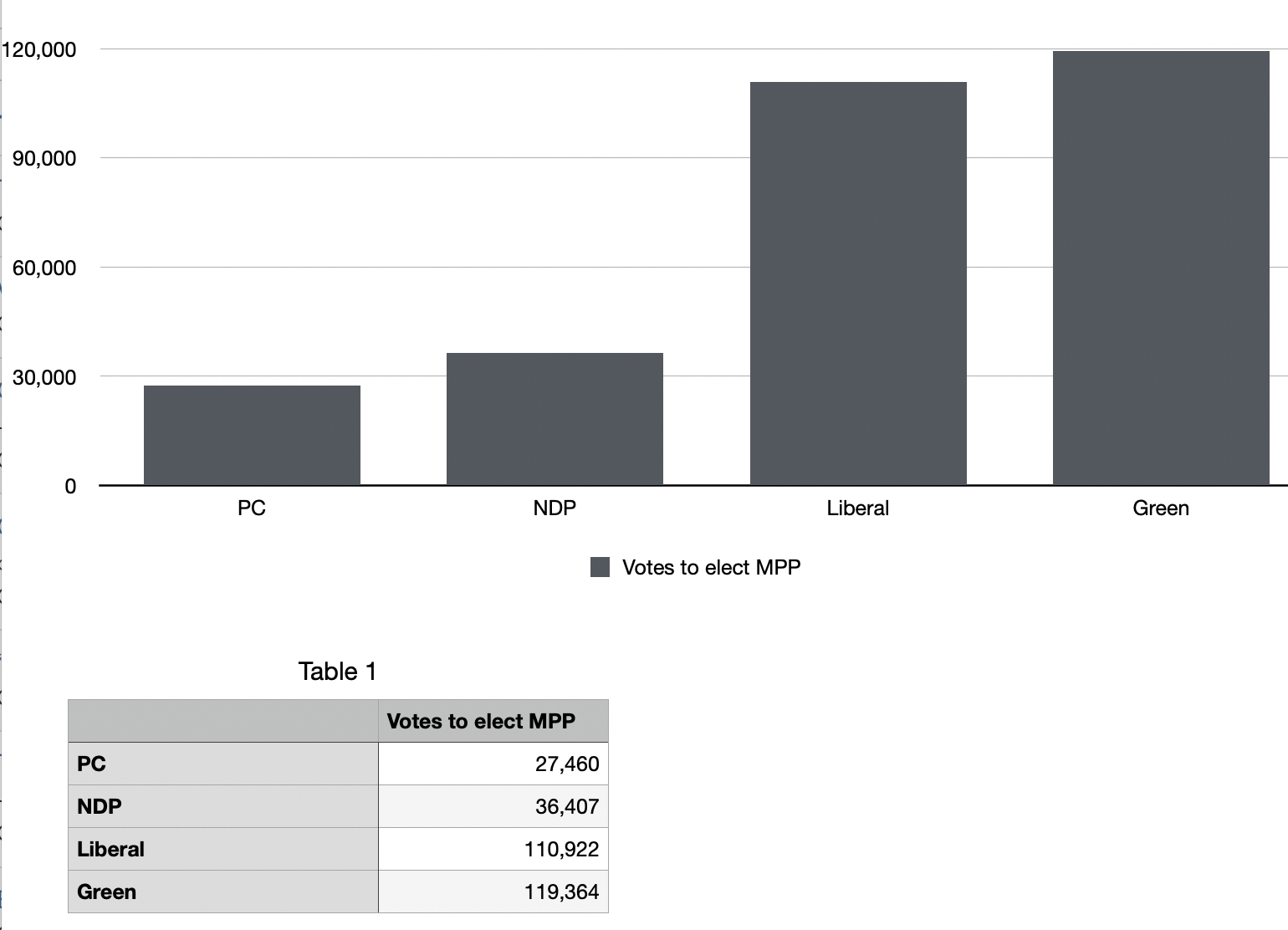

People seeking political office at the highest level have a duty to make their views known on the big issues of the day. The perceived unfairness of an electoral system which gives the NDP official opposition status at Queen’s Park with many, many fewer votes than the Liberals is, surely, worthy of comment?

Saying you are there to listen to people – rather than express an opinion, tentative or otherwise - is a complete cop-out.

How on earth did it come to this?

This email address is being protected from spambots. You need JavaScript enabled to view it.

Note: Vote totals and percentages exclude all minor parties.

- Details

- Written by Gordon Prentice

Mark Carney will be sworn in as Canada’s 24th Prime Minister later today.

I learn from Larry Elliott – the economics editor of the UK’s Guardian newspaper throughout Carney’s time as Governor of the Bank of England – that Carney had

“…a volcanic temper and Bank staff were wary of getting on the wrong side of him. As a governor he was respected but not especially liked.”

The volcanic temper was news to me - as it probably is to the Liberal Party members who voted for him. But I am sure they were all beguiled by the pollsters’ predictions that put Carney within touching distance of the Conservatives’ Pierre Poilievre.

To them, he is clearly the man of the moment.

Heavy lifting

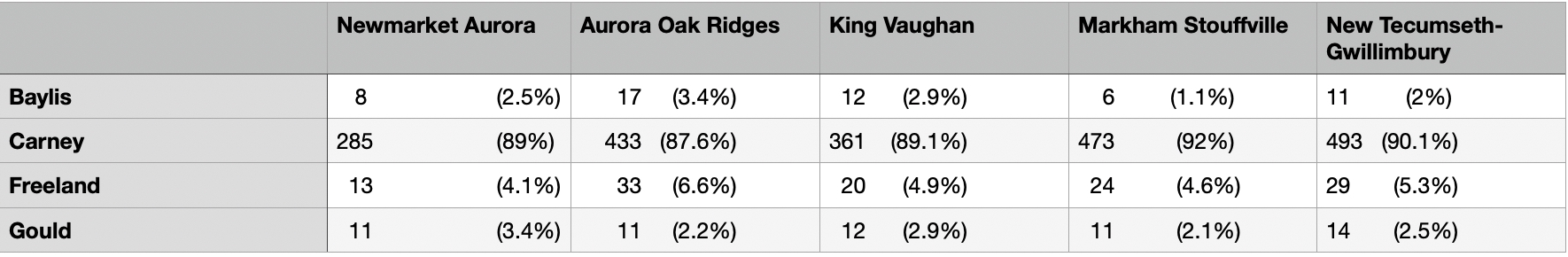

Carney won a landslide victory here in Newmarket-Aurora, which mirrored the national vote. The 317 people – card carrying Liberals – who actually participated in the ballot constitute a tiny fraction of the voting age population. Under half of one per cent.

This isn’t a complaint. Members of political parties do the heavy lifting for the rest of us.

We don’t have mass membership political parties in Canada.

Selling memberships

But “membership” numbers inflate massively during Party leadership contests when, astonishingly, the wannabe leaders can sell Party memberships to their supporters.

This leads to clientism and cronyism and should be outlawed. I take the old fashioned view that people participating in Party leadership votes should have been members of the Party for, say, six months beforehand. Just to show some affinity to the Party in question.

And it’s not just the Liberals I’m getting at. The Conservatives too sell memberships on an industrial scale.

Soft underbelly

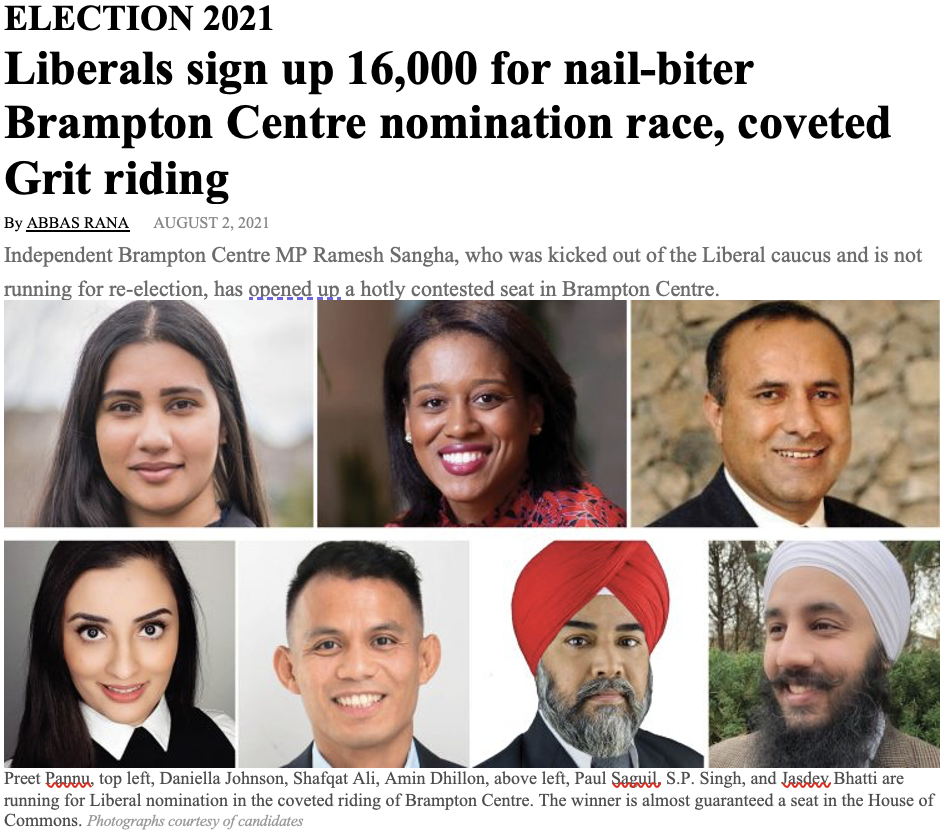

The nominations process is the soft underbelly of Canadian democracy.

In some ridings, memberships balloon into the thousands during nomination contests for candidates for the House of Commons. These are the phoney members who disappear as soon as the contest is over.

In some safe ridings, winning the Party nomination is a passport into the House of Commons.

Getting selected is the challenge. Getting elected is the easy part.

Quest for truth

The former Liberal MP and one time wannabe Liberal Prime Minister, Ruby Dhalla, who was disqualified by the Party, is on a "quest for truth".

She wants to know what happened to the 250,000 “registered” Liberals who didn’t make it through the certification process.

Seems to me that if her registered Liberals can’t be bothered to answer a few simple questions to prove they are who they say they are (and in a vote that will decide the next Prime Minister of Canada) then what’s the point of being a “registered Liberal” in the first place?

This email address is being protected from spambots. You need JavaScript enabled to view it.

Note 1: The Liberal results by riding are here.

Note 2: There is no membership fee to join the Liberal Party of Canada.

Click "Read More" for the Globe and Mail report of 11 March 2025: Fewer than 40% of 400,000 registered Liberals voted in leadership race

Read more: 285 Liberals in Newmarket-Aurora voted for Mark Carney (and that was a landslide)

- Details

- Written by Gordon Prentice

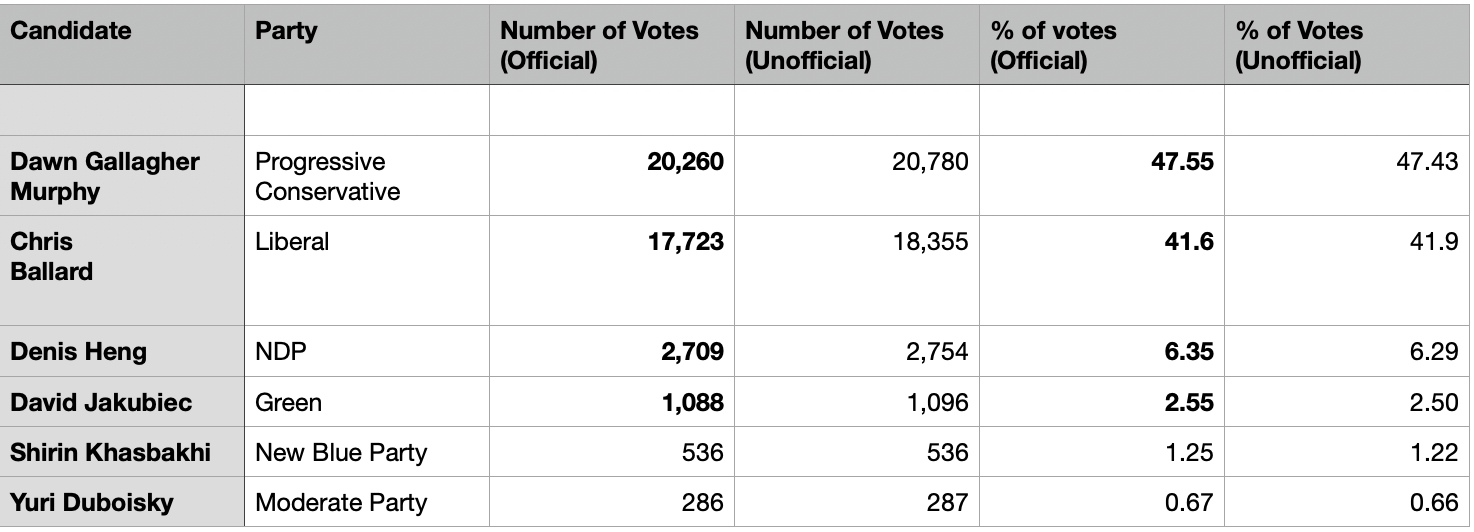

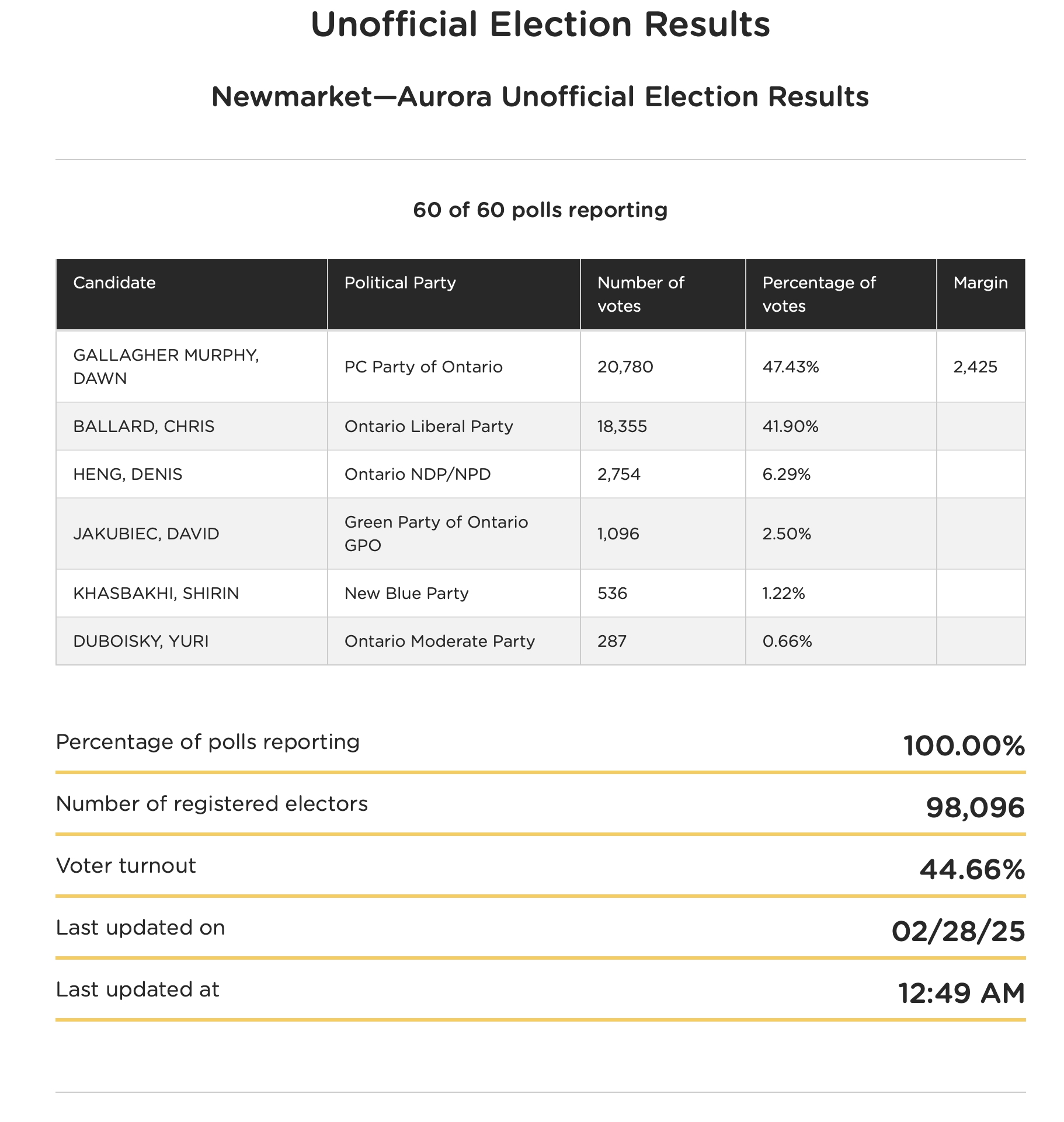

Last week, more people in Newmarket-Aurora didn’t vote for Dawn Gallagher Murphy than did. But she was still 2,537 votes ahead of her only serious challenger, the former Liberal Cabinet minister, Chris Ballard.

But if the vote for the centrist Liberals (17,723) had combined with the vote for the NDP (2,709) then, interestingly, the Progressive Conservatives' Gallagher Murphy (20,260) would have lost to my hypothetical LibDipper by 172 votes.

Of course, this is just a daydream. We are doomed to see this election outcome replayed again and again until the centre left parties get their act together. Too often the Liberals and NDP see themselves as mortal enemies who repeatedly split the vote allowing the PCs to waltz through the middle.

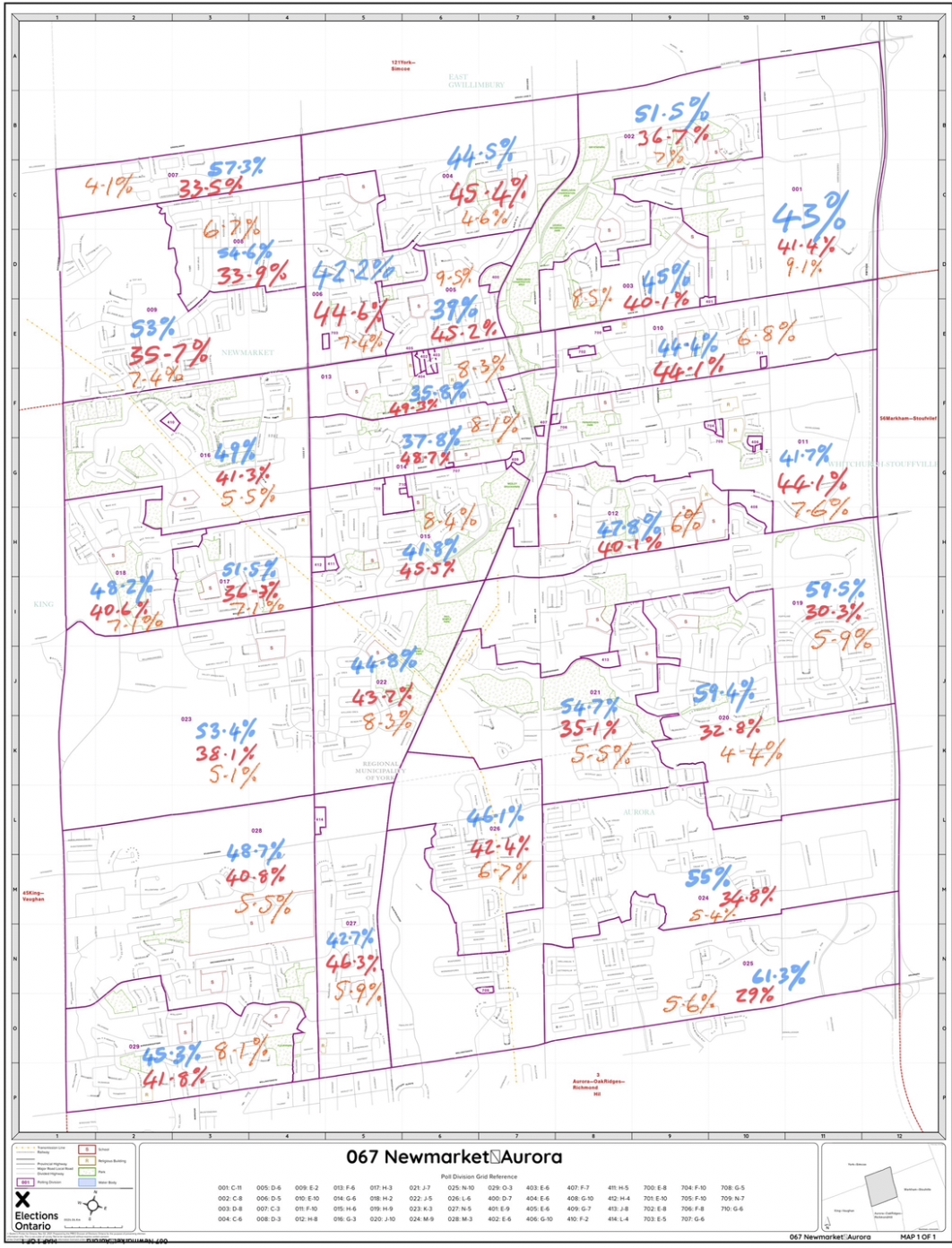

Mapping support for the Parties

Voting for the conservatives was, as usual, heaviest in Stonehaven and Copper Hills and the south eastern part of the riding. The Liberals did better in their traditional territory, the central spine of the riding between Yonge and Bayview with support concentrated in the old downtown area with its leafy streets and character. The NDP did not poll above 10% in any polling division.

The Liberals had the highest vote in the advance polls. The full results are here with details of voting at retirement homes, condos and other specially designated polling places.

Voter Turnout

The big story for me was the collapse in voter turnout. Here in Newmarket-Aurora it was an anorexic 43.76% - down from 44.42% in the previous Provincial election on 2 June 2022.

We do not know what would have happened if more people had voted. But, as a rule of thumb, conservatives do better when turnout is low. In fact, the lower the better.

This time, with Gallagher Murphy again boycotting candidate debates, refusing to answer legitimate questions about her behaviour towards her own employees and sticking with the simple message "Canada is not for sale" she sailed through the campaign to another easy win.

Contrived

Doug Ford called the election 16 months early in the depths of winter claiming he needed a renewed mandate to fight Trump’s tariffs.

Yet his own riding had a pitifully low turnout of 34.4%. Two thirds of his own electors didn’t believe the hogwash about a new mandate and stayed at home.

As it stands, the PCs have three fewer MPPs than when Ford called this contrived election. (Some results are subject to recounts.)

We slept through this election and wake up to find Ford is back in the saddle for the next four years.

But in a few months time we can expect a Federal Election in Newmarket-Aurora, though run on materially different boundaries.

We shall see what happens then.

This email address is being protected from spambots. You need JavaScript enabled to view it.

Note: The recently published official results from Elections Ontario differ, in some cases quite significantly, from the unofficial results published immediately after the election on 27 February 2025. The table above shows the official results for Newmarket-Aurora with the unofficial results alongside.

Updated on 9 March 2025 to include details of the new redrawn boundary of the Federal riding of Newmarket-Aurora.

Update on 18 March 2025: From TVO's Steve Paikin: Analysis: Did the Opposition Parties help Ford win another majority?

- Details

- Written by Gordon Prentice

Now that Doug Ford has convincingly won the “Trump tariff” election I am left wondering what he intends to do with his new mandate.

The Progressive Conservative platform, published only days before the election and after people had already cast their ballots in advanced voting, is now required reading.

Some of Ford’s promises are, of course, total non-starters. There is absolutely no possibility that Ford can

“Deliver a new driver and transit tunnel expressway under Highway 401 to provide a new, faster route through Canada’s busiest and most gridlocked section of highway, helping thousands of daily commuters get where they need to go faster.”

It’s a non-deliverable $100 billion dollar commitment aimed at construction workers who are some of Doug’s most fervent supporters.

More billions on health

On health – where he again promises to spend billions - will the Ford Government underwrite the cost of a new Southlake? Unless the Provincial Government’s longstanding policy is changed, the Province will not pay for the land acquisition costs for new hospitals. So that means Southlake has got to find the money for its second site out of its own resources – or rely on a benefactor. It is not as if the Province is short of money:

“A re-elected PC government will continue to deliver on its ambitious plan for hospital expansion, with more than $50 billion to build or upgrade 50 hospitals across Ontario.”

Ford says he will be

“Encouraging municipalities to also accelerate and bring forward billions of dollars worth of planned municipal public infrastructure project tenders for roads, bridges, water and other infrastructure builds and repairs to get more people working faster and improve our economic competitiveness.”

Streamline

And to help them spend all these billions of dollars Ford says the Government

“will further streamline Ontario’s environmental assessment process”.

I wait for details on that one.

There are, of course, all sorts of measures that never rated a mention in the PC Platform but will be dumped on us out of a clear blue sky. What if municipalities don’t move quickly enough to deliver on Ford’s agenda? What will he do? Abolish them or force them into mergers with their neighbours?

Who knows?

Gallagher Murphy walks on water

Anyway... as we all now know Dawn Gallagher Murphy has been returned as our MPP in Newmarket-Aurora.

She endured bad publicity but followed the old dictum: "Never explain. Never complain".

She took it all on the chin and it worked.

She got 47.4% of the vote with Chris Ballard trailing on 41.9% – a difference of 2,425 votes (but down from her winning margin of 5,602 in the June 2022 election).

By the time of the next election we shall have forgotten all about the racist banter, the bullying and harassment.

Squeezed

The NDP and Green vote was squeezed but it wasn’t enough to make a difference. The NDP vote dropped from 12.7% in 2022 to 6.3% yesterday. The Green vote went down from 5.6% to 2.5%.

The New Blue Party, which could have eroded the PC lead, took only 1.2% of the vote down from 3.6% in 2022.

Province wide, Ford’s Progressive Conservatives took 42.9% of the popular vote – up from 40.8% in 2022.

Non voters win

More people in Newmarket-Aurora didn’t vote in yesterday’s election than did.

Turnout Province wide was 45.4%. In Newmarket-Aurora 44.6%. (Based on Elections Ontario unofficial figures)

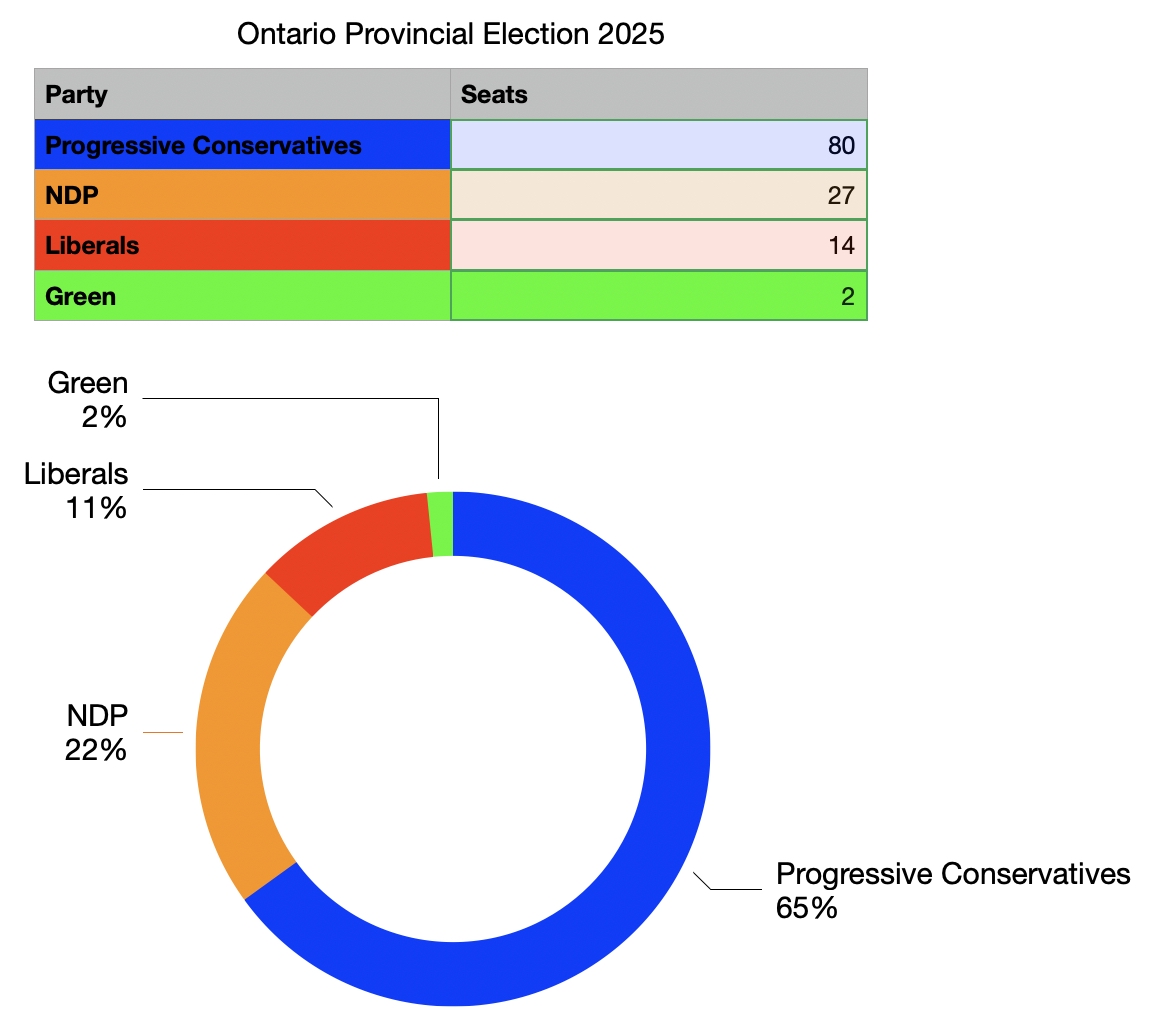

First-Past-the-Post is brutally efficient in delivering majority governments from a minority of the vote. As the table shows, it takes 119,364 votes to elect a Green MPP and 27,460 to elect a PC MPP. The more concentrated the vote geographically the higher the seat count.

Celebration

Last night the NDP was celebrating its return to Official Opposition status getting 27 seats on the back of 18.5% of the vote. The Liberals got 14 MPPs with 29.9% of the vote.

It seems to me the Liberals and NDP have got to reach some kind of accommodation to stop both parties from running against each other in winnable seats, splitting the vote and letting the PCs in through the middle.

Easier said than done.

But not impossible.

This email address is being protected from spambots. You need JavaScript enabled to view it.

- Details

- Written by Gordon Prentice

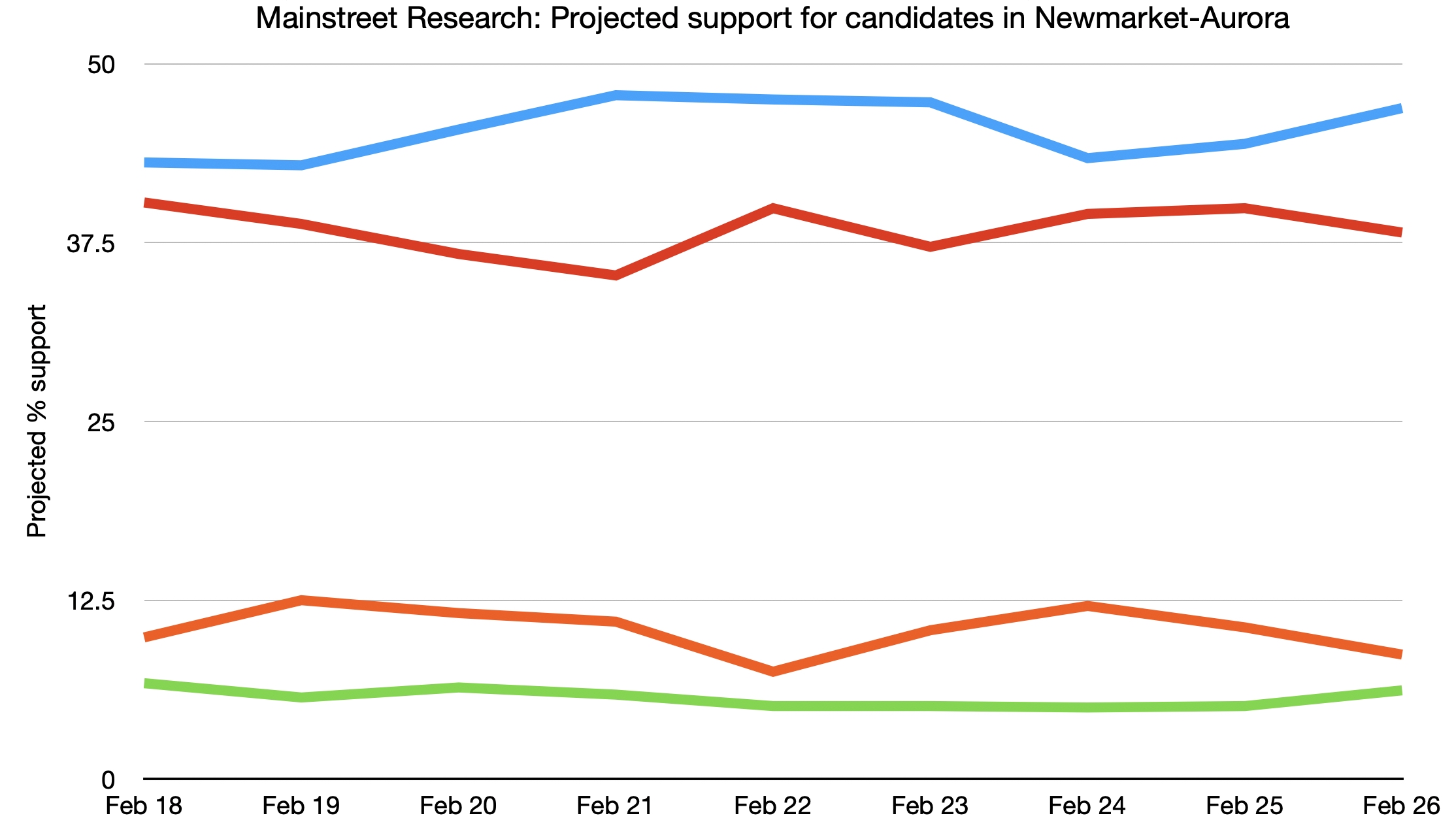

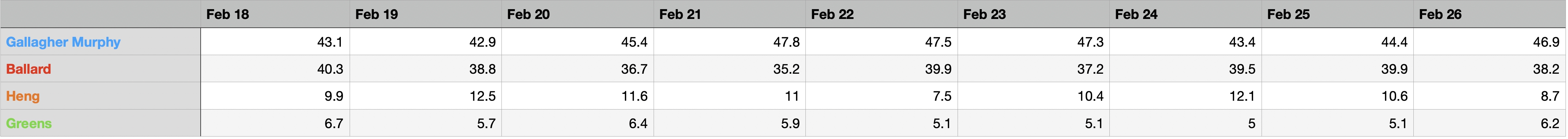

This latest poll from Mainstreet Research (26 February) projects Dawn Gallagher Murphy as the clear winner in tomorrow’s Provincial election in Newmarket-Aurora.

I am not so sure.

A lot will depend on turnout.

If people stay at home, believing the result in Newmarket-Aurora is a foregone conclusion, then Dawn Gallagher Murphy will win.

She has spent years courting every demographic under the sun, telling them what they want to hear. Putting on a face. She is relying on them to turn out.

Serfs

And yet, the same Dawn Gallagher Murphy has faced a blizzard of bad publicity for avoiding debates with other candidates and for her appalling personal qualities. She routinely bad mouths people. She treats her staff like serfs.

I simply don’t know if most people are aware of this.

This has been a comatose election, called in the dead of winter, with all the polls predicting a third win in a row for Doug Ford and his Progressive Conservatives.

Lawn signs are virtually non-existent. One or two stakeboards on the major highways and that’s about it.

Polls influence elections

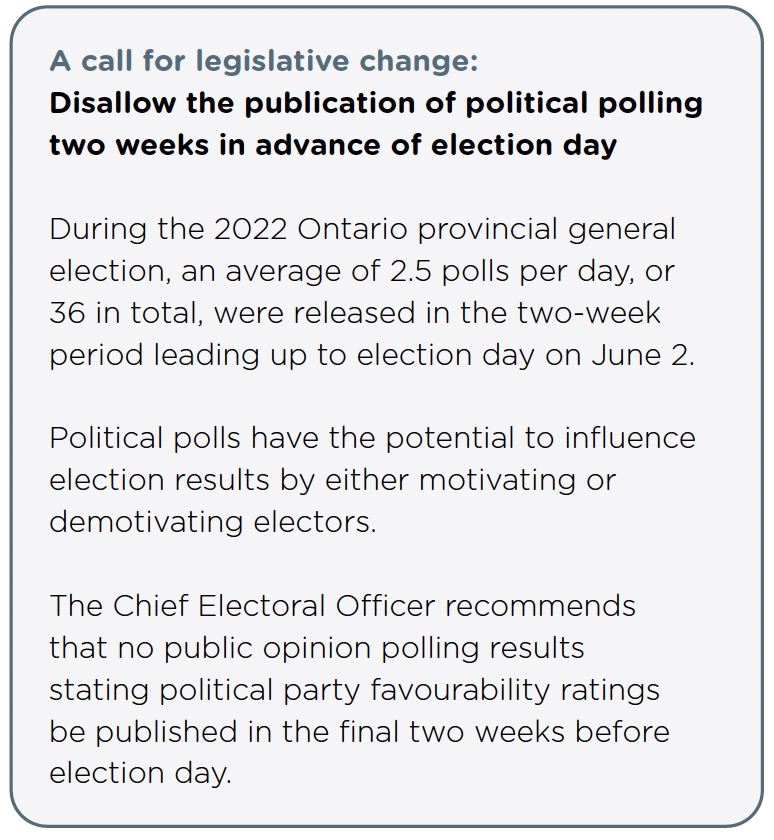

After the last election in 2022 which saw the lowest turnout ever in a provincial election, the province’s chief electoral officer controversially called for a ban on publishing the results of political polls in the two weeks before election day.

There is no chance of that happening any time soon (if ever) but it should start a debate especially if turnout tomorrow crashes through the floor.

Tactical voting is key

Tactical voting can make the difference here in Newmarket Aurora if NDP and Green people vote for Ballard, the only candidate within striking distance of Gallagher Murphy.

And we know for a fact there are conservatives in our riding who wouldn't vote for Gallagher Murphy if you paid them.

So there is everything to play for.

I hope Chris Ballard does well tomorrow.

He has my vote.

This email address is being protected from spambots. You need JavaScript enabled to view it.

![]()

Page 10 of 287